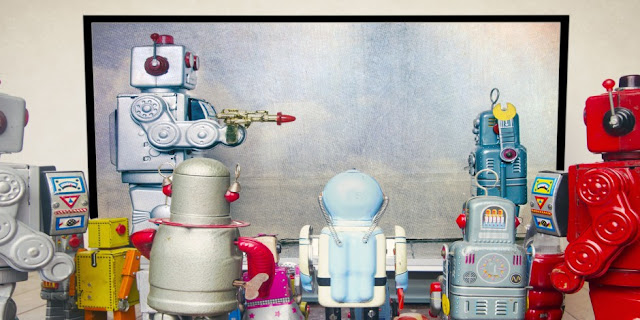

CTV the Centre of Media, Streaming and Commerce

The Home Screen The Centre of Media As the global media industry enters 2026, one reality is now clear: connected TV is no longer emerging — it has arrived at the centre of the media ecosystem. What began as an extension of linear television has evolved into the primary convergence point for streaming, advertising, creators, commerce and device innovation. In markets around the world, CTV is no longer competing for attention — it is defining how attention is discovered, measured and monetised. The past twelve months have accelerated this shift. Streaming platforms have expanded their advertising models, creators have moved beyond mobile-only distribution, a...